The Emerald Island Blog

PTI government to establish real estate regulatory body

ISLAMABAD: The federal government has decided to establish a Real Estate Regulatory Authority (RERA) to manage the affairs of real estate with an appellate tribunal to settle the disputes of the concerned sector.

The real estate developers will have to register with the authority for the sale of plots, houses or buildings. For the purpose, the government has finalised the Real Estate Regulation and Development Bill 2019. Real Estate Regulation and Development Act is expected to be implemented later through a presidential ordinance.

According to a document available with The Express Tribune, the Real Estate Regulation and Development Bill 2019 has been finalized, which will serve as a tool for effective management and promotion of real estate sector and according to which, RERA will be formed. According to the bill, prior approval from RERA will be mandatory before starting work on any real estate project.

Source: The Express Tribune

Incentives designed to boost foreign remittances to Pakistan

According to a statement issued by the Prime Minister’s Office, Khan during the meeting allowed the State Bank of Pakistan and its authorised dealers (banks) to “implement Business to Customer (B2C) and Customer to Business (C2B) transactions through foreign correspondent entities under their existing home remittance agency arrangements”.

Incentives regarding B2C transactions:

- Freelance and information systems services have been allowed to transact up to $1,500 per individual per month.

- Transaction services other than computer and information services have also been allowed to transact up to $1,500 per individual per month.

- Pensioners can now receive up to Rs250,000 per individual per month.

For C2B transactions:

- Residents can easily receive direct payments from overseas Pakistanis to pay for utility bills, education fees of Higher Education Commission-accredited institutions, superstores, insurance companies, credit card bills, etc.

- Remittances received by “reputed” real estate builders/developers and housing societies from overseas Pakistanis on account of purchase of property such as residential and commercial houses, plots, flats and buildings, etc. have also been allowed except remittances for equity/participation in an enterprise.

The prime minister also approved a proposal for the government to pay an incentive or Rs2 for the use of mobile wallet on each transaction of $1 remittance as airtime; this amount was previously one rupee.

For foreign exchange companies and banks that bring in 15 per cent more remittances than the previous financial year, an incentive of Rs1 will also be granted against each $1 incremental remittance transaction.

Source: DAWN

Government allows overseas Pakistanis to purchase property Tax Free

The newly elected government of Pakistan with Imran Khan as Prime Minister, has removed the condition of being a tax-filer for overseas Pakistanis to purchase properties in the country and individuals acquiring properties through inheritance.

This decision was taken to attract foreign investment by non-residents investing in the real estate sector.

The decision is also applicable on individuals acquiring property through inheritance.

2018 Property Tax Reforms

Property Tax Reforms: On any property that a citizen purchases, they will have to pay a one per cent ‘presumptive tax’. That tax will be adjusted in their annual taxes.

A Maximum of 1pc tax (local and provincial) for registration of property being recommended. At federal level Adjustable Advance Income Tax being reduced to 1pc only.

The FBR rate on property being abolished from 1st July 2018 and provinces being requested to abolish the DC rate, a handout of the prime minister’s announcement read. No purchase of property over Rs4 million is possible for non-filers of tax returns from July 1, 2018.

To avoid under-invoicing [in property sale and purchase deeds], the government now holds the right to buy any property that a citizen holds by paying 100 per cent over its declared price. This will hold for six months from the registration of the property starting fiscal 2019.

The rate will fall to 75pc in fiscal 2020, and 50pc in fiscal 2021 to disincentivise under reporting.

LDA Bans Commercial Status on Eighteen Roads in Lahore

LAHORE: The Lahore Development Authority (LDA) has finally banned temporary/annual commercialisation on 18 major city roads and people are told to wind up their businesses till June 30, 2018, and revert their premises to original building plans in compliance with LDA law.

These 18 roads have commercial businesses worth billions of rupees with major local and multinational companies. A strong reaction from the traders is expected in coming days, sources said, adding permanent commercialisation on these roads was already banned.

Commenting on massive alteration/demolition consequent, to this ban, LDA DG Zahid said even under temporary commercialisation the owners were not allowed to alter original building design, but in majority of cases this rule was violated. This step has been taken to cope with the problems associated with increasing commercialisation, he said, adding the LDA will not accept any pressure to withdraw its decision.

The 18 major roads include Tollinton Market Road (LOS Chowk to Jail Road Junction), Zafar Ali Road (Gulberg V), Campus Bridge Road, Garden Town (Canal Bridge to Y Junction), Shah Jillani Road (College Road Township till Hamdard Jail Road), Khayaban-e-Jinnah (Shaukat Khanum to Raiwind Road), Canal Bank Road (from district boundary Wagah to Thokar Niaz Baig), Canal Bank Road (from Thokar Niaz Baig to District Boundary), Main Boulevard, Sabzazar Scheme (Fawara Chowk Multan Road to Liaquat Chowk and Liaquat Chowk to Multan Road), Link Raiwind Road (Raiwind Road to Aitchison College Gate), Main Boulevard Johar Town/Khayaban-e-Firdousi (Maulana Shaukat Ali Road to Shaukat Khanum Hospital), Bypass Road Johar Town (Canal to Wapda Town roundabout), Wahdat Road (Naksha Stop plot 70 Block C New Muslim Town to Multan Road Chungi), Qazi Essa Road (Faisal Town), Raiwind Road (Thokar Niaz Baig to Defence Road Manu Chowk), Abu-ul-Hasan Isfahani Road (Faisal Town roundabout to Akbar Chowk except property no 30, 31, 32, 33 and 34 Block B Faisal Town), Maulana Shaukat Ali Road (Segment 2 starting from Model Town Link Road and ending at junction up to Railway crossing), Hamdard Jail Road (from Pindi Stop to Plot no 1222-5-D1) and Defence Road (Multan Road to Raiwind Road). Temporary and permanent commercialisation was allowed in past and recent past on the above mentioned roads despite the fact these roads were declared frozen for any kind of change in land use, LDA sources said, adding LDA had allowed temporary commercialisation on frozen roads whenever it needed money and all future implications were ignored at that time.

Under ongoing open temporary commercialisation policy of LDA, one can get any property commercial after getting NOCs from the neighbours and paying heavy fees to the authority. This resulted in extraordinary increase in value of land/properties, sources said, adding LDA designated commercial areas in its schemes are ignored and laying vacant.

To a question that the election is just round the corner and LDA may face political interference in implementation of this decision, the DG said Chief Minister Shahbaz Sharif has given a free hand to LDA for making and implementing policies. He said LDA wants to end temporary commercialisation policy and to achieve this goal LDA will soon suggest amendments to related laws.

Talking about a possible reaction from the business community, the DG said no one is above the law. He said temporary commercialisation didn’t mean that the said property is declared commercial on a permanent basis. “Temporary is always temporary and LDA has rights to revise/change this policy,” the DG concluded.

On the other hand, traders and business community strongly criticised the decision and said they will go to every extent to get the decision reverted. They said billions of rupees had already been spent on establishment of business outlets, restaurants, marriage halls, marquees and etc. on these main roads while hundreds of thousands of workers and their families are associated with these businesses.

Author:Ali Raza, Source: The News Pakistan, Published: 14th Dec, 2017

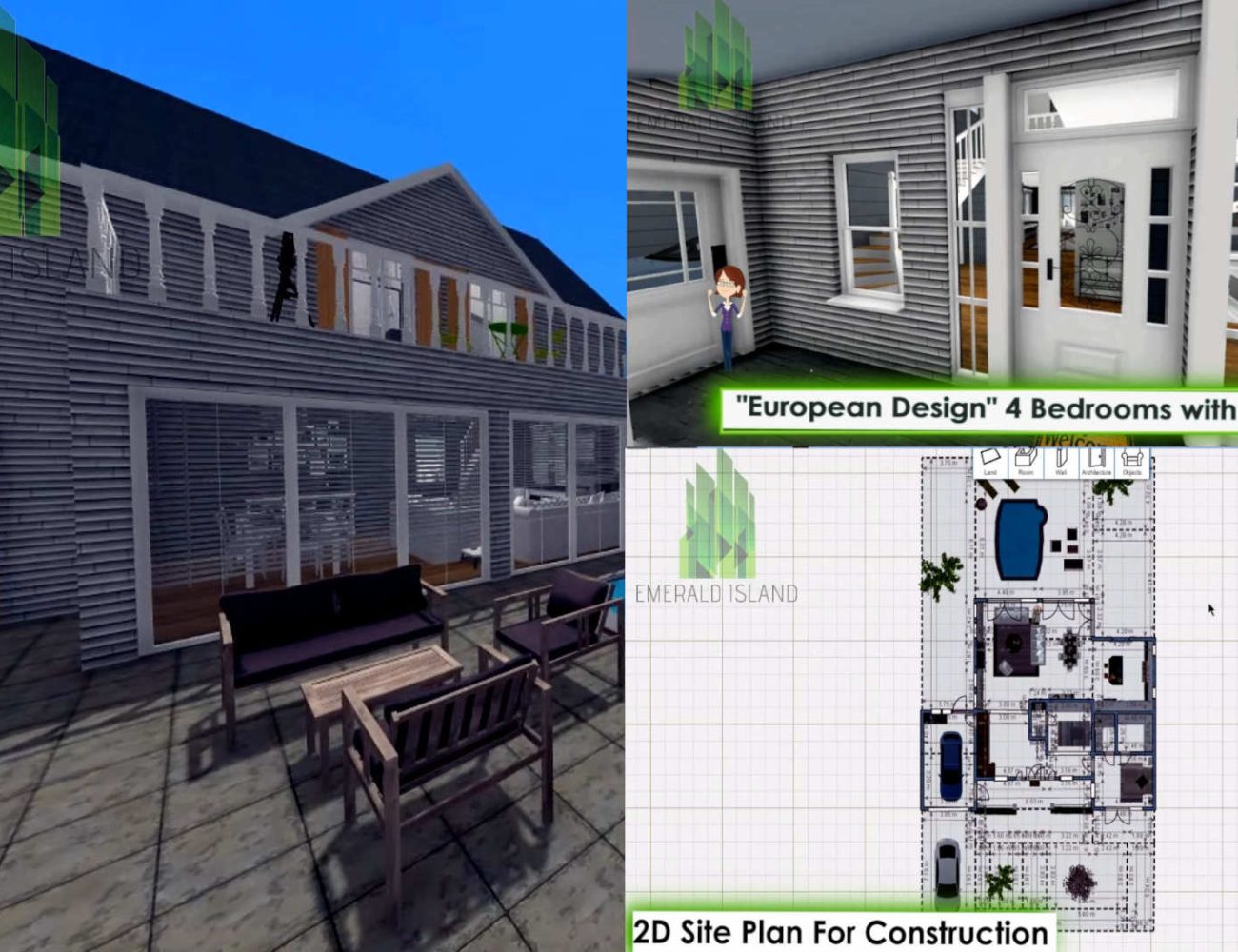

Apartment Living in Lahore Pakistan

Apartment buildings are on the rise (pun intended) in Lahore, a majority still at construction stage. Apartment living in Karachi has been the norm since Partition! Islamabad followed suit some 2 decades ago.

Now it’s Lahore’s turn, and about time too.

Medium to Small Unit Housing (MSUH) has been increasingly squeezed into the suburbs. Which is fine really, and inevitable as cities grow. Except in most big cities around the world, business moves to the suburbs as well, as do schools etc. Local governments ensure not only proper infrastructure for housing colonies to develop but also encourage institutions to move their office complexes to the suburbs.

Small unit, affordable housing has become a rarity in the city. Demand outweighs supply by a vast margin. Sure, you are spoilt for choice in the suburbs. Many a developer have built ready-to-move-into houses. Not many though build with integrity.

Good or bad,the price is heavy in terms of long, arduous drives into the city, despite wider roads, under-passes, over-heads, ring roads, more traffic cops, public transportation – you are still going to need to commute to your place of work, your favourite department store etc.

That’s where the magic of apartment living comes in.

You can select a choice location, central, in the middle of urban Lahore.

You can cut down your cost of commuting – time-wise.

You can decide to go off for the weekend to the hills without extensive planning – just lock your apartment door and leave without fear of theft.

Less hired help, simpler living – and more money to spare.

However when you buy or rent an apartment do ask:

– who built it – get the architects name and look him / her up for credentials

– ask about earthquake proofing

– ask about sound-proofing

– find out if the Maintenance Committee is particular about profiling who rents and buys

– verify what the monthly maintenance charges are, with a break-down

– check what facilities you are getting – security being most important and back-up power a close second

– make sure the building’s by-laws state clearly that the usage of the apartment is purely residential (no allowance for commercial)

– make sure you get dedicated parking with the apartment

Last but not least – if you have pets, check if they are allowed, and get it in writing lest a another resident objects at a later stage.

If you tick-mark all of the above you are in for joyous living!

Arsh Rahman

Managing Director

Em Isle

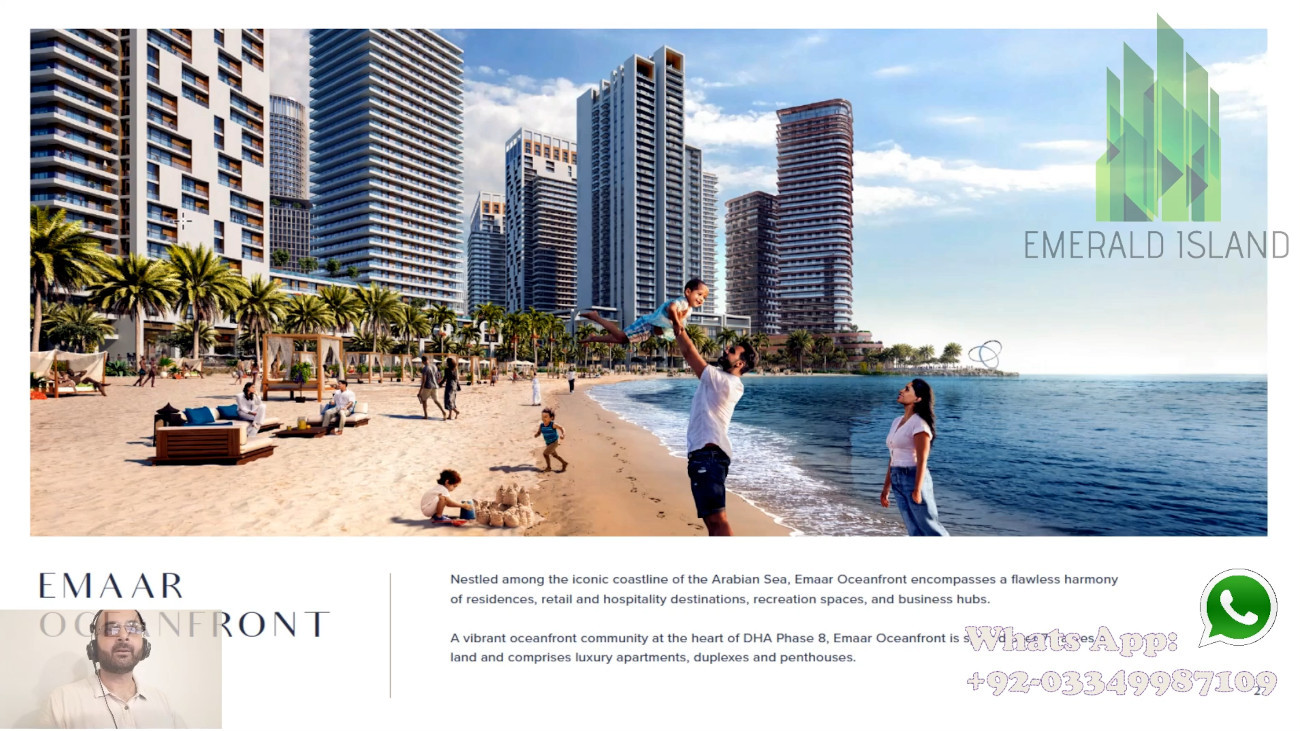

Dubai Commercial Property Explained

In the last five years, investment in commercial property in Dubai by Pakistani investors has increased by approximately 15%. This is primarily due to the fact that purchasing and renting property in Dubai is relatively easy for Pakistanis, and the expected return on investment (ROI) on commercial property is quite high.

Popular commercial property options include:

Office space can be purchased and rented in several high-rise buildings; popular commercial pockets include Business Bay (where several buildings are under construction), Dubai Creek, Sheikh Zayed Road and TECOM. Sheikh Zayed Road is of particular interest to Pakistani investors because office space there is smaller (and therefore more affordable) compared to the other areas.

Covered area range: 600-7,000 square feet

Monthly rental range: AED 68-98 per square foot

Purchase price range: AED 1,100-1,300 per square foot

Retail space in malls continues to be a popular option among investors. Most malls in Dubai have anywhere from 300 to 1,200 retail spaces available; malls where retail space is in high demand are located on Dubai Creek, Dubai Marina, Financial Centre Road, Jebel Ali and Sheikh Zayed Road.

Covered area range: 628-5,500 square feet

Monthly rental range: AED 300-1,600 per square foot

Purchase price range: AED 1,000-1,800 per square foot

Standalone shops and showrooms are being established in several residential areas, including Dubai Investment Park, Dubai Marina, Jumeirah Village and Palm Jumeirah. All are attracting investors because they are comparatively cheaper than retail spaces in malls. However, most of these are currently under construction.

Covered area range: 628-5,500 square feet

Monthly rental range: AED 80-200 per square foot

Purchase price range: AED 1,000-1,300 per square foot

Facilities available in all three commercial property options include:Cargo lifts, central air conditioning, internet access, maintenance, parking space and round-the clock-security.

Source: DAWN

3D Printing for Pakistan Construction

3D printing is one of the most fascinating technological advancements of our time. It has everyone from artists to scientists giddy with the limitless possibilities. 3D printers use materials (including resin, plastic and metal) to print 3D objects, ranging between six to 24 inches in height; smaller objects are usually printed separately, and assembled to create larger ones.

As far as architecture is concerned, 3D printing is used primarily to create scale models. This enables architects to achieve geometric accuracy, manipulate dimensions to enhance aesthetics and practicality, and save time in building miniatures that can be used as displays and as a point of reference during the construction phase.

Architects are now using 3D printing for more than just models. For instance, Adrien Preistman, a British architect, has moved to the next level by designing the first ‘printed’ construction element; he used small, complex joints in the plastic roof canopy of the 6 Bevis Marks building in London. Printed in pieces, these joints serve as nodes between the building columns and arms of the canopy.

Meanwhile, Behrokh Khoshnevis, a professor at the University of Southern California, has designed a method to print habitable structures using the principles of contour crafting, in which massive objects can be printed layer by layer. This technology has caught the interest of NASA, and Khoshnevis is now designing structures that can be used to colonise the moon and other planets using his technology.

It certainly seems as if we already have all the components to live in a 3D printed world – even in Pakistan. The country’s first 3D printing facility, Robotics Labs, was established in 2011. But considering the higher costs of 3D printers and printing materials ($60 to $200 per kilogramme), it is less likely to have practical implementation in the local architectural industry soon.

Source: DAWN

2016 Real Estate Taxation Laws and Amendments Explained in a Nutshell

Update 29th November 2016

Amnesty Scheme Approved!

According to this Amnesty, property investors will be required to pay 3% tax on the difference between the DC rate of property and prices declared by the Federal Board of Revenue.

The National Assembly committee has suggested the government charge 1% in total as Withholding Tax, Advance Tax and Capital Gains Tax (CGT) on property transactions

On fixing valuation tables a major concern for all investors, the committee has recommended that the FBR immediately modify the flaws in the valuation tables with the consent of stakeholders. The government will incorporate these recommendations in the Income Tax Ordinance 2016 Amendment Bill.

This Amnesty will boost the depressed real estate market, stop the flight of capital from the country and bring back expat Pakistani investors!

Update 8th August 2016

FAIR MARKET EVALUATION: FBR & Property Valuation Tables

Only applicable to Federal property taxes

- G.G.T (between 1 & 2 yrs:7.5%, between 2 & 3 yrs: 5%, 3yrs +: 0%

- WHT – WITHOLDING TAX (only if value is more than 4 million (previous 3 million)

- SECTION 111 of the INCOME TAX ORDINANCE (unexplained income / assets)

Property Valuation Tables

- Property Valuation Tables for Major Cities has been released with a revised DC Rate which our Agency has in it’s custody.

- E-mail Emerald Island for more information.

Update 1st August 2016

The Finance Minister has announced the following amendments due to the massive backlash against Tax Ordinance and Finance Bill changes.

FBR will be sole evaluators

State Bank will not be part of the property evaluation process. Instead we have the Federal Board of Revenue overseeing the fair market evaluation of properties in Pakistan. A lot of work has been put into updating the valuation table of property prices for 18 major cities throughout the country.

DC Rate will stay

It has been proposed in the Finance Minister’s Meeting that the DC rate will not be abolished but increased in order to bring the DC rate closer to the actual fair market value of the proeprty being sold.

CGT (Capital Gains Tax)

The Government has reduced the holding period of properties from 5 years to 3 years.

- 10 percent on property held for 1 years

- 5 percent on property held between 2-3 years

- 0 percent for a property held for more than 3 plus years!

For Armed Forces personnel martyred in the line of duty their properties and subsequently their inheritors are exempt from CGT.

The information below on Property Tax has been Revised

- State Bank Evaluators

An important amendment has been made to Section 68 of the Income Tax Ordinance 2001 through the Finance Act 2016, which will be effective from July 1 2016.

Under the amendment, the property evaluation rate set by the provincial governments will no longer remain relevant.

All investors will have to get their properties evaluated through the evaluators of the State Bank of Pakistan (SBP) under a new mechanism which will bound the investors to get their properties evaluated through State Bank of Pakistan (SBP) and then refer it to FBR Inland Revenue Department. The SBP will fix the real market value of the immovable property and then refer it to the FBR Inland Revenue Department.

- DC rate has been abolished

The Deputy-Commissioner (DC) Rate will not remain valid from July 1, 2016.

Previously, when a property transaction took place the buyer would sign two agreements with the seller. One of the agreements carried the actual price whereas the other agreement showed the sale of property at the undervalued rate. The first agreement is meant for the two parties to avoid any fraud whereas the second agreement is shown to the registration authorities for transfer of property on undervalued rate. This second agreement reflecting undervalued rate of the property referred to as DC rate will no longer be valid.

- Withholding Tax/Advance Tax

The government has imposed 2 percent withholding tax on Non filers on the purchase of immovable property of all sizes, including plots, flats, houses, residential and commercial properties . For income tax Filers (tax payers) the withholding tax is 1 percent on purchase of immovable property of all sizes, including plots, flats, houses, residential and commercial properties.

- Capital Gains Tax

Capital Gains Tax (CGT) has undergone changes in terms of time frame. CGT will be levied at the rate of 10% of difference between the fair market value at the time of sale and purchase only if the property is sold within 5 years of its purchase. This is a flat rate with a time frame of 5 years. If the property has been held longer than the 5 years the Capital Gains Tax does not apply to it at the time of sale.

Source of Data for the above Article:

- Federal Board of Revenue

- Business Recorder

- Dawn

Investing In Vacant Commercial Plots

The demand for commercial plots has increased by 15 to 25% in the last three years. This is because purchasing vacant plots has proven to be a lucrative option for investors, since these plots require minimal maintenance and are relatively easy to resell.

If you are thinking of purchasing a commercial plot, here are a few guidelines that you should keep in mind:

When purchasing a plot, make sure that the ownership title is in the name of the person you are buying it from. The seller’s name should be on all relevant property documents; these include the transfer or allotment letter, tax payment receipts, and receipts of conversion fees, if the plot was initially a residential one and later converted for commercial use.

In order to prevent any future objections with regard to ownership, place a notice in a newspaper that conveys your intent to purchase the plot in question.

If no claim to the plot is made within 15 days of publishing the notice, a clearance certificate will be issued by the concerned authorities (including Cantonment, DHA, LDA and KDA). This certificate is essential for the transfer process.

Have soil testing conducted by qualified surveyors; the results will define the quality of soil and its characteristics, which will dictate the type of construction that is possible.

Check the construction of saleable area (COS) ratio; this determines how much construction is permitted on the plot. In most neighbourhoods, the ratio ranges between 1:3 and 1:5.5. The higher the COS ratio, the higher the permissible square footage of the built-up area.

One of the most profitable uses for a vacant plot is a paid parking-lot; this option gives a substantial ROI (return on investment).

Do not leave a commercial plot vacant for too long. Begin construction work within six months or have a boundary wall constructed to keep it secure.

Source: DAWN

Property Auctions

Property auctions are gaining traction in Pakistan, where high-value private and government owned properties go under the hammer. A significant number of foreclosed properties (that were used as collateral and are being sold by banks and other lending institutions to recover defaulted loans), as well as those located in remote areas that are difficult to sell through conventional methods, can be purchased at such auctions.

Properties at these auctions are usually priced five to 10% less than their current market value, and buyers usually do not have to pay third party commissions to agents and dealers, which makes them more economical in the long run.

If you are looking to purchase property through auctions, factor in the following:

- Look out for auction advertisements in newspapers and real estate websites.

- Prior to the auction, visit the property in person to determine if it fulfils your requirements.

- Determine the status of unpaid bills, taxes, loans and any litigation issues associated with the property; this will help you calculate any additional costs you will have to incur.

- Auctioneers advertise the estimated price of the property – the range varies between 80 and 110% of the value – and this will give you an estimated bidding price, ensuring that you do not overspend.

- In order to reserve your spot, you will be required to submit a refundable security deposit (approximately five to 10% of the property value) with the auctioneer at least a month before the auction.

- If you win an open bid auction, you will have to make a non-refundable down payment, which usually ranges between eight to 10% of the bid value.

- In closed bid auctions, you will have to write your bidding amount on paper and submit it to the auctioneer, along with a pay order amounting to 10 to 25% of the estimated price. All bids are opened publicly, and if you are the highest bidder, the property will be transferred in your name. The remaining amount will be required within 30 days of the auction to confirm ownership.

Source: DAWN

Karachi’s Tallest Building!

The largest real estate developer in the country, Bahria Town, officially launched Karachi’s tallest 62-storey tower, Icon, with the onset of the new year. It’s a beautiful building with a terrific view of the city’s skyline. Just gorgeous! The project features a mega mall, the country’s highest restaurant, state-of-the-art technology and more.

Chinese Company Buys Land in Pakistan for Housing Scheme

A Chinese firm is due to set up a housing scheme of over 500 acres in Gujranwala, Pakistan, this year. Interestingly, 2,500 houses of 5 marlas each will be constructed that will be allocated to the general public at large. In addition, 3,000 plots are to be given to lower income households.

Want To Visit Islamabad’s Centaurus Mall? That’ll Be Rs.100

Centaurus Mall is one of Islamabad’s hottest attractions. Yet the mall’s management caused a roar on social media when it announced on Thursday that the mall would enforce an entry fee of Rs. 100… to go shopping.

However, that isn’t what rubbed people the wrong way. In a public notice, the administration of the mall also included an exhaustive list of people who would be exempt from paying the fee, which by the way includes every single person who can actually afford to pay it.

Government officials and ‘celebrities’ are exempt from paying the Rs. 100 fee. Exempt also are women, children, senior citizens, members of bar councils, ‘Famous Players of Hockey, Cricket, Football and Golf’ and ‘Doctors and teaching faculty of all Universities.’ So who exactly is the mall trying to keep out?

This attempt at class policing was not taken lightly and the focus soon shifted on how it was attempt to single out people from Pindi. Everyone loves the mall so why the discrimination, Centaurus?

Source: Dawn

Pakistanis Buy Dubai Property Worth $379 Million In Three Months!

Pakistanis remained in pursuit of real estate in Dubai in the first quarter of 2015 as third biggest amount of foreign property transactions $379 million came from Pakistani nationals.

Pakistanis purchased properties worth over $4.3 billion (16bn dirhams) in 2013 and 2014 in Dubai.

According to data released by Dubai Land Department in April 2015, Pakistani nationals made transactions worth $379m (1.392 billion dirhams) during the first quarter of 2015.

In terms of investor numbers, however, Pakistanis stood second with a total of 953 investors, only behind Indians with over 1,000 investors.

Pakistanis also make up the second largest non-Arab nationality in the UAE.

In a January a market sentiment survey, a large number of respondents said they only wanted to invest in Pakistan. However, 49pc of participants who wanted to invest abroad wished to buy property in Dubai.

Bayut.com, a Dubai-based property portal, shared some insights from its UAE real estate market database.

The figures divulged by this portal registered a quarter-on-quarter (Q1’14 to Q1’15) hike in searches originating from Pakistan regarding buying property in Dubai. Pakistanis’ searches for buying property in Dubai went up to 87.29pc in Q1 2015 from 85.40pc in Q1 2014, suggesting an increased intent of buying rather than renting property.

The data revealed that there were more Pakistanis searching for apartments up for sale in Q1 2014 (82.94pc) than villas (14.54pc). However, there was a drastic shift in the search trend in Q1 2015, as a whopping 24.42pc of searches from Pakistan related to the villa segment, while the searches for apartments dropped to 24.42pc.

The data also revealed a significant rise in the searches related to office spaces up for sale, going up from 1.19pc in Q1 2014 to 5.22pc in Q1 2015.

Again, this hinted at an increasing inclination of Pakistani businessmen to set up offices in Dubai, especially in the face of opportunities being presented by the approaching Expo 2020.

Area-wise, most Pakistanis hunted properties in the top luxury segment, with 55.73pc of Q1 2015 searches dedicated to apartments in Dubai Marina area, a top choice locality for expats commanding average price of 2,262,334 dirhams (Rs62 million).

Downtown Dubai, where average apartment prices hover around 3,364,547 dirhams (Rs94 million), came in second place with 7.2pc of searches focused on the area.

In the villa and townhouse segments, most Pakistanis (28.43pc) looked for buying properties in Jumeirah Islands, where average prices falling around the 7.7m dirhams (Rs215m) mark.

In searches for rental apartments, Dubai Marina was the top choice again, with average rents of around 115,000 dirhams per annum.

A mere 12pc of Pakistanis looking for rental spaces in Q1 2015 meant not many from Pakistan headed to Dubai for work, hence the low demand for rental spaces.

It was in contrast to UK and US search trends data, as figures for Q1 2015 suggested an almost equal interest of Americans in buying and renting, while 60.87pc of people in UK searched properties for sale compared to 39.13pc who wanted to rent.

However, there was a five per cent surge in Americans’ interest to acquire office spaces in Dubai in Q1 2015, which could mean an increasing intent of US nationals to do or start a business in Dubai.

The higher number of Americans and Britons looking for rental spaces was due to the fact that a lot more westerners travelled to Dubai to work in the corporate sector.

Source: Dawn

The Multiplex Building Trend In Pakistan

Multiplex buildings are high rise buildings with apartments and commercial shops on the ground floor. They are very popular in Karachi and are catching on in other cities such as Lahore and Islamabad.

The covered areas of apartments ranges between 2,000 and 3,000 square feet. The size of retail spaces is 80,1200 and 2,400 square feet. The size of plots they are built on is 1,000 to 2,000 square yards.

Since Karachi is the benchmark for Mulitplex Buildings in Pakistan have a look at the chart in the image above which shows you property prices for these projects. An investor will benefit greatly through rental value and property appreciation over time if they choose to setup a multiplex building project.

Source: Dawn News

Gated Communities in Pakistan On The Rise!

Gated communities are residential areas that are enclosed within a boundary wall. In Pakistan, the trend of gated communities emerged a decade ago, and demand for housing there has gone up by an estimated 30% in the last two years due to an increasing need for secure and well maintained housing communities.

Here is a detailed look:

- Gated communities are usually built on large plots measuring between five and 10 acres and comprise houses and apartments.

- In Islamabad and Lahore, they are located near the city centre. In Karachi they are located on the outskirts of the city. (This is due to the fact that unlike Islamabad and Lahore, large plots of land are not available within Karachi’s city limits.)

- In addition to a boundary wall, other security features include entry and exit points that are manned by security guards, round-the-clock patrols and surveillance via CCTV cameras.

- Houses are built on plot sizes ranging between 125 to 1,000 square yards and usually comprise three to four bedrooms.

- Apartments have a covered area ranging between 1,500 and 2,000 square feet and usually have two to three bedrooms.

- In addition to basic utilities (such as electricity, gas, sewerage, water and telephones), several gated communities provide additional features including independent water supply and backup generators.

- Amenities include well-planned commercial pockets, community centres, gymnasiums, parks, mosques, swimming pools and libraries. Some of the upscale gated communities have golf courses, hospitals and schools.

- The value of property in gated communities is approximately 12 to 15% higher compared to property in nearby areas.

Source: Dawn News

Residential Property Bylaws in Islamabad

Source: Dawn News

DHA Prism9 – Phase 9, Lahore – Balloting of Plots in May, 2015

Defense Housing Authority (DHA) Lahore has launched its 9th phase of a housing and commercial project. The name of this phase has been announced as ‘PRISM9.’ Balloting of plots in this DHA phase will be held on May 15, 2015.

DHA is offering modern facilities in this phase, such as: Street Wi-Fi, a Water Theme Park, Saddle and Polo Park, Golf Course, Business park, Drive-in Cinema, Food Street, Under Water Zoo, Fully Serviced Apartments, Hospitals, Schools, and more.

Karachi real estate fast losing ground to Lahore, Islamabad

We all know that Karachi is probably the worst place to live in if you own an expensive mobile phone. Really bad choice that. Karachi is widely touted to be the real estate capital of the country. But that title is now under threat from both Lahore and Islamabad. Despite having taken a huge hit over the past couple of years, the city’s real estate market still has some life left in it, but maybe not for long.

According to data recent trends show that investors no longer consider Karachi their first, or even second choice for that matter, when it comes to making investment decisions. This is specifically true when it comes to buying a house. But if it is real estate – specifically residential land – you want to buy, if you invest in Karachi, you still cannot go wrong. But even here, Karachi is losing ground – literally.

Lahore is now the first choice for real estate investors, with Islamabad a close second. According to search trends, in the first half of 2012, there were 2.2 million searches for real estate in Lahore followed closely by Islamabad at 2.1 million. Karachi was a distant third at just 1.5 million searches. The monthly trend gives no real indication that this slide is likely to reverse in the near future.

In fact, Rawalpindi, because of its proximity to Islamabad, is up at fourth and has been holding steady or making marginal gains in the first half of this year.

If we break this up, then Lahore is the clear cut leader when it comes to the ideal location for living or buying land for investment. Islamabad is the second target for real estate investors, but still behind Karachi as a choice for residence.

According to data, for land, it is just DHA Phase VIII in Karachi which is still a major draw, and that too because now people are able to take possession of land for construction. Without this saviour, Karachi would have been even further behind. Phase VIII is larger than the rest of DHA combined, so it has the potential to affect trends. Surprisingly enough, number two on the list is not Clifton, but Gulshan-e-Iqbal.

This perhaps is the main reason why Karachi is falling back: the lack of good choices for investors. Gulistan-e-Jauhar was supposed to become the next big thing, offering affordable accommodation, but security issues have stunted growth. Lahore has several prime zones like DHA Bahria Town, Gulberg, Wapda Town, Cantt, and Johar Town. Islamabad has areas like DHA, Bahria Town, G-13, E-11 amd G-11 among others.

There is one thing one can say for Karachi. It is tough. Despite all the security and law and order issues and the crime and the scarcity of water – all the things that investors consider when making choices – the flow of investment has slowed down, but hasn’t dried up. The interest is there, and, according to property dealers, it won’t take more than a few months of sustained peace before Karachi will once again become a big draw for buyers. The question is, will there be peace?

Source: The Express Tribune

Property Market Poised for Recovery?

Pakistan’s real estate market is expected to regain this year some of the sheen it had lost in 2014.

Last year had proved to be a very dull year for the property market because of security and political conditions, as well as other inherent factors that hampered growth of this sector, said Akber Sheikh, a major developer from Lahore.

Like him, some others are hopeful that the market will ‘recover some of its momentum’ seen in 2013 in the wake of a smooth transfer of power from one elected government to another.

“Returns on investment in real estate/property were lower than the expectations of investors, as the market moved much slowly than in 2013,” Zeeshan Ali Khan, CEO of a property portal, said.

“At certain points during the year — for example, during and after Ramzan — the market even came to a complete standstill for a while. But despite the problems, the year saw excellent growth in some areas and became stable.”

The low return on investment means many Pakistanis are investing in Dubai’s real estate. According to a leading Dubai property portal, Pakistanis invested AED3bn in Dubai in the first half of 2013. This investment burgeoned to AED4.5bn in the first six months of last year.

“For Pakistanis, investment in Dubai property amounts to hedging against currency devaluation, as the Dirham is tied to the dollar; so they are virtually investing in dollars. Besides, the return on investment and equity are much higher than in Pakistan,” Zeeshan said.

Most investors and developers consider political uncertainty and poor security conditions as the biggest factor behind last year’s ‘slower growth in the market’. Yet, they say these factors are temporary. Several regulatory and other factors are also stopping the property market from realising its full potential.

“Lack of transparency in land records, very high interest rates, and weak legal and regulatory protection for investors are a few major factors hampering growth of real estate in Punjab in particular and the rest of Pakistan in general.

“If we want to attract investors in this sector, we will have to create a more transparent market through digitisation of land records, establish a strong and functional regulatory authority, develop a mortgage market, and bring down interest rates to the regional level,” Zeeshan argued.

Mortgage rates in Pakistan are in the range of 15-18pc, compared to 2.15pc in Hong Kong, 2.7pc in Japan, 7-8pc in China and 8-12pc in India. “High interest rates are hampering growth of the property sector and are detrimental to the construction and the 30 allied industries. They are also the reason why our housing finance-to-GDP ratio is below 1pc, whereas in India it is 9pc.

“Even lending by the House Building Finance Corporation is available at 16pc. Interestingly enough, India had followed our HBFC model and established its own HDFC. But it has grown much faster than Pakistan’s HBFC,” he said.

Additionally, the developers must be facilitated by government agencies. “The government should create a fund like a Real Estate Investment Trust to support private developers to spur growth in the property market,” the co-founder of the property portal said.

Most agree that Pakistan’s real estate market is cheaper than India’s — as far as urban property prices are concerned. For example, property prices in Islamabad are about 30-40pc cheaper than those in New Delhi. “But if you go to suburban areas, property prices in Pakistan may be higher than those in India,” Zeeshan added.

The fact that property prices in Pakistan are still affordable as compared to India is one of the many reasons why our rate of urbanisation of 3.2pc is higher than India’s 2.01pc. However, India has done a good job at increasing housing supply by adopting a more liberal mortgage policy, low interest rates and supporting its private sector.

Meanwhile, property rentals have grown faster than real estate prices in the last one year. “Rentals are driven up by the gap between demand and supply. Property in general and land in particular is an investment product and investors can afford to hold off their investments and wait and watch. Tenants, on the other hand, unfortunately don’t have that choice,” Zeeshan said.

He said the average rental yield in Pakistan is between 3-4pc. “Even high rental yield areas like Johar Town, Lahore, and Clifton, Karachi, offer a return of about 5-6pc per annum, meaning it will take an investor about 20 years to recover his investment in terms of rental income. This is also why a lot of investment goes into Dubai because the rental return there is about 8-10pc.

“Property is a very strong investment product, particularly because ours is a cash-based market that is largely risk-free. Almost everyone has a real estate concern, and this includes people from all walks of life; businessmen, government employees, bankers all invest in real estate.”

A major chunk of investment in real estate is coming from overseas Pakistanis. “For the majority of overseas Pakistanis, property is the investment of choice. Pakistan received $16bn in remittances in the last financial year. Of this, $2-3bn was directly invested in real estate. So anyone who has some savings prefers to invest in property since the market has never seen a crash like the stock market,” he concluded.

Source: Dawn